The smart Trick of Vancouver Tax Accounting Company That Nobody is Discussing

Wiki Article

The Single Strategy To Use For Pivot Advantage Accounting And Advisory Inc. In Vancouver

Table of ContentsTax Accountant In Vancouver, Bc for BeginnersThe Basic Principles Of Vancouver Accounting Firm The Ultimate Guide To Vancouver Tax Accounting CompanyIndicators on Tax Accountant In Vancouver, Bc You Should KnowThe smart Trick of Vancouver Tax Accounting Company That Nobody is Talking AboutA Biased View of Vancouver Tax Accounting Company

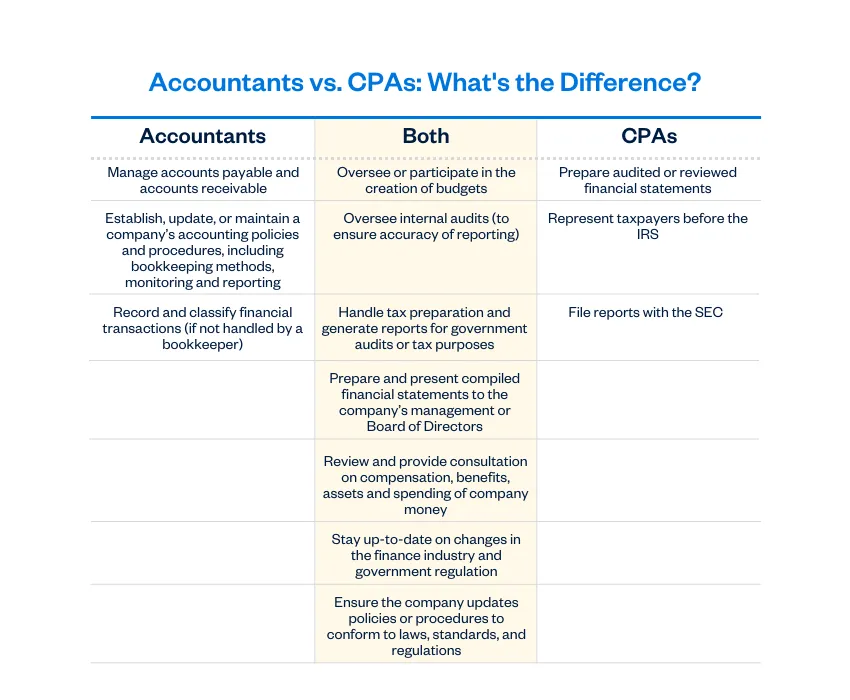

Here are some advantages to working with an accountant over an accountant: An accounting professional can provide you a comprehensive view of your business's economic state, in addition to approaches as well as recommendations for making financial decisions. Bookkeepers are just responsible for videotaping economic deals. Accounting professionals are called for to finish more schooling, accreditations as well as job experience than bookkeepers.

It can be challenging to evaluate the appropriate time to employ an accountancy expert or bookkeeper or to identify if you require one in any way. While several small companies work with an accounting professional as a professional, you have a number of options for managing monetary jobs. Some little service proprietors do their own bookkeeping on software program their accounting professional suggests or makes use of, offering it to the accounting professional on a weekly, monthly or quarterly basis for activity.

It may take some background research study to find an appropriate accountant due to the fact that, unlike accounting professionals, they are not needed to hold an expert accreditation. A solid endorsement from a trusted coworker or years of experience are essential elements when hiring an accountant. Are you still uncertain if you require to employ somebody to aid with your books? Below are three circumstances that indicate it's time to work with a financial professional: If your taxes have ended up being as well complex to handle by yourself, with several income streams, foreign investments, a number of deductions or other factors to consider, it's time to hire an accounting professional.

The Basic Principles Of Cfo Company Vancouver

For small companies, skilled money monitoring is a critical facet of survival and development, so it's sensible to deal with a financial expert from the beginning. If you like to go it alone, take into consideration beginning with accountancy software application and also maintaining your publications carefully as much as day. By doing this, need to you require to hire an expert down the line, they will have visibility into the complete financial history of your company.

Some resource interviews were carried out for a previous version of this article.

The Best Strategy To Use For Small Business Accountant Vancouver

When it involves the ins visit their website and also outs of tax obligations, accounting and finance, nonetheless, it never harms to have an experienced expert to turn to for support. An expanding variety of accountants are also dealing with things such as money flow forecasts, invoicing as well as HR. Inevitably, most of them are taking on CFO-like functions.When it came to applying for Covid-19-related governmental funding, our 2020 State of Small Organization Study discovered that 73% of local business proprietors with an accounting professional said their accountant's suggestions was essential in the application procedure. Accounting professionals can also aid entrepreneur avoid costly errors. A Clutch survey of small company proprietors programs that even more here are the findings than one-third of little businesses list unexpected expenses as their leading financial difficulty, followed by the mixing of service and individual financial resources as well as the inability to obtain repayments on time. Little organization owners can anticipate their accountants to help with: Selecting business framework that's right for you is necessary. It affects just how much you pay in tax obligations, the documents you need to file as well as your personal obligation. If you're aiming to transform to a different organization framework, it might cause tax obligation repercussions and also other problems.

Even companies that coincide size and sector pay really different amounts for accountancy. Prior to we enter buck figures, let's chat about the costs that enter into local business accountancy. Overhead costs are prices that do not straight become a revenue. Though these costs do not transform right into money, they are essential for running your service.

More About Small Business Accountant Vancouver

The typical expense of audit solutions for tiny company varies for each one-of-a-kind circumstance. The average month-to-month audit fees for a small organization will certainly increase as you include more solutions as well best site as the tasks get tougher.For instance, you can record purchases as well as process pay-roll using on-line software application. You get in amounts into the software, and also the program calculates overalls for you. In many cases, payroll software for accounting professionals allows your accountant to supply pay-roll processing for you at extremely little additional cost. Software program options are available in all shapes and dimensions.

Examine This Report on Small Business Accounting Service In Vancouver

If you're a new entrepreneur, do not fail to remember to element audit prices right into your budget plan. If you're a professional proprietor, it could be time to re-evaluate bookkeeping costs. Administrative prices and accounting professional charges aren't the only accounting expenses. Vancouver tax accounting company. You need to likewise think about the impacts accountancy will certainly have on you and your time.Your capacity to lead workers, serve customers, and choose might experience. Your time is also beneficial and should be thought about when considering audit expenses. The moment invested on accountancy tasks does not create profit. The less time you invest in bookkeeping and also taxes, the more time you need to expand your company.

This is not intended as legal recommendations; for more details, please click below..

The Of Pivot Advantage Accounting And Advisory Inc. In Vancouver

Report this wiki page